Trading uk was found with aim to provide online traders with trusted and Safe forex brokers in United Kingdom. we have team of reviewers at Trading

uk that reviews forex brokers in United Kingdom to ensure that Trading uk is relevant for online trading uk beginners and trading pros.

online trading uk is one of the most beneficial way to make money trading online uk has analyzed all brokers based in the uk to insure our customers certification. We have team of brokers and reviewers that make sure that you always get the best trading services in the uk.

UK Trading Platforms

| Forex Brokers | Minimum Deposit | Support | Rating | Visit Site |

|---|---|---|---|---|

1  | $ 20 | 98.05% | Start Trading | |

| One of the Best Forex Brokers in UK | ||||

2  | $ 50 | 99.99% | Start Trading | |

| Markets.com the Trusted Broker in UK | ||||

3  | $ 50 | 98% | Start Trading | |

| Rated the Best Broker in UK | ||||

4  | $ 30 | 100% | Start Trading | |

| xm.com is rated the Best Broker in UK | ||||

5  | $ 100 | 99.5% | Start Trading | |

| Iron FX the Top Broker in UK | ||||

Benefits of Trading UK

- Free online trading uk Guide.

- Safe brokers.

- Free widthrable bonuses.

- Lower fees

- More control and flexibility

- Access to online tool

- investments in real time

Trading UK Guide.

Most of our brokers offer variety of beginners guides in form of PDF books.Demo accounts are

always available were by 7000 pounds or more is loaded in your demo account for you to do

trading until you’re satisfied or rather ready to start trading. In most cases beginners

prefer a demo account the is no time limit you can use a demo account until you’re satisfied

to trade with your own money.

What is online stock trading?

Online stock trading is basically a process of buying and selling stocks of business entity (Company)

via the internet at the comfort of your home. In most cases it is referred to as share dealing

and trading. Shares are regarded as certain units of ownership in a Company. The listed brokers

have sophisticated platforms that will allow you to accomplish buy those units in company

(share dealing). To buy or sell share you use trading platform software that allows you to

trade online.

You can start Stock trading or trading online by follow the below tips

If you want start stock trading in, we advise you to create an trading account from our listed

and trusted software providers or broker. Then after creating the trading online account

then add the required funds in the account using the deposit method of your choice, you can

use VISA, Mastercard, Skrill, PayPal and many more start buying shares and selling shares

online at comfort of your home.

Steps to follow when trading online in Summary:

- Create an Account.

- Fund the account with the minimum deposit

- Choose your trading platform- This would the software you use to conduct your trading.

- The Software will allow you to manage financial markets and managing market positions, an

online broker will be at your side during the entire process to make sure that your guided

on the correct path to trading online.

Online stock brokers

Our listed stock brokers offer the best support depending on the traders needs. Just remember

the online stock broker is the middlemen between the trading stock markets and you. This

online stock brokers differ

- Advisory broker – They suggested the best shares that you can buy.

- Discretionary brokers– They sell shares on your behalf and buy them on your

behalf, their knowledge so that they earn you more profit. - Execution only brokers– This type brokers they take instructions about trades

from you.

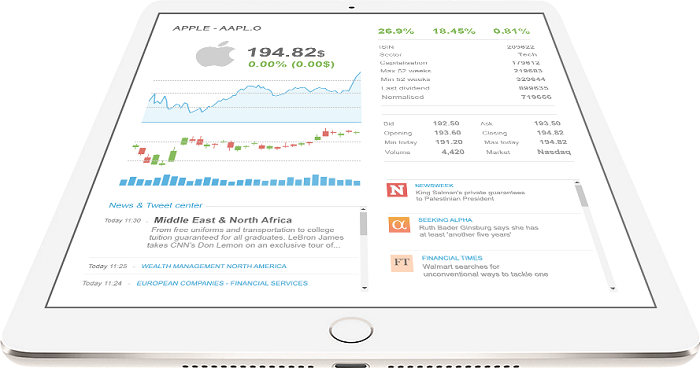

Online Trading platforms

trading platforms are offered in different kinds , we offer platforms form XM, Markets.com ,

hycm and many more this brokers offer cutting edge technology when it come to market trading

platforms in the united kingdom.

When looking for trading platform you consider the following:

- Fees

- Access to data and research

- Trade options

- Margin loans

- Security

Risk about online trading

we try by all means to minimize the risks for our traders we make sure that you start trading

with verified trading companies in the country. Most people always encounter problems were

by most brokerage companies close their business before funding clients with their money.

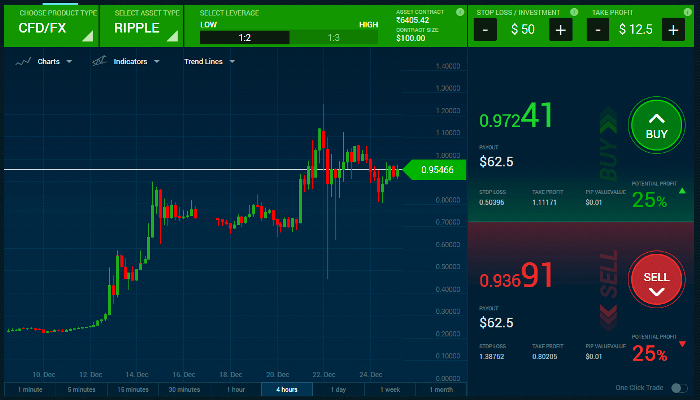

Forex trading: Forex trading is the of buying and selling currencies in the

to make profits on the difference in the value of such currencies in the global economic

landscape.

Options trading:Options trading is a form of derivative trading in which people

do trades that give them the rights to buy or sell an underlying asset at a predetermined

price.

Binary option trading:Binary options trading is a form of trading in which traders

expect to earn a predetermined payout or nothing at all based on the success of their ‘prediction’

of the outcome of a specific market event.

Developing a Online trading strategy

The main differentiating issue between Stock trading Associate in investments is that a merchandiser actively seeks out market movements for profit

whereas an capitalist usually waits to exploit long-run worth movements within the assets

in their portfolio. A merchandiser can usually create tens or many trades among every week

whereas Associate in Nursing capitalist is content to shop for Associate in hold an plus

for months or years.

No merchandiser will afford to underestimate the importance of a online strategy – the primary

step in making your trading strategy is to own a trading online set up. A Forex set up is

cherish writing a business set up for Associate in Nursing entrepreneurial pursuit. A trading

set up helps you create logical tradition call is periods of fast market movement after you

emotions would possibly lead you to create rash selections.

Your trading strategy ought to embrace a market ideology – a particular goal (getting out of

debt, retiring early, creating your initial million) acting as your motivating issue to hunt

your fortune within the market. Your Online trading strategy ought to embrace your plus allocation

and diversification moves – as a beginner, you must not have quite five-hitter of your Online

trading capital on any single trade.

The trading online chart on top of shows that Tesla has been in an exceedingly consistent uptrend

marked by rising support and resistance trend lines – as an example, the stock is trending

owing to a catalyst like a product launch or changes in management – within the last 3 weeks.

the knowledge that the stock chart provides will encourage you to hold/buy a lot of shares

of Tesla if you’re thinking that that the uptrend can continue. Of course, you won’t hesitate

to sell your Tesla shares to lock in your gains if you’ve got reasons to believe that Tesla

is at the height of the uptrend.

Your Forex strategy ought to embrace risk limits like abundant cash you’ll afford to lose in

an exceedingly forex online session (ideally less than five-hitter of your capital) and the

way much loss you’ll afford to book in every trade (ideally, less than I Chronicles of your

Online trading capital).

Also, certify your trading strategy contains a combination of elementary analysis (for example,

world events, like wars that impact oil worths) and technical analysis (trading rules supported

price and volume transformations). you must use this info to work out your entry into trades,

your exit once the trade goes your manner, and your escape once the trade goes against your

plans. it’s your best interest to develop the adherent to include stop/limit loss orders

into each trade you place.

Using technology to beat the educational curve

Technology will facilitate new traders lower the entry barriers to trading online by automating

several of the activities that would need a good deal of mental effort to trace. Below square

measure some pointers for exploitation technology to become a far better merchandiser within

the shortest doable time.

Stock screeners

If you’re stocks trading, finding the proper ones are often troublesome as a result of there

square measure just too several to choose from. several tiro traders tend to follow the herd

mentality, which means they solely trade the ‘big name’ stocks that create headlines, whereas

many ‘quiet’ stocks square measure providing seasoned traders with consistent gains. If you

trade stocks supported news alone, you’ll possibly miss the massive gains; the execs typically

get in or out of such trades before it hits the headlines.

A stock guard will assist you sieve through the thousands of stocks within the market to slender

down potential winners before their massive breaks. it’ll assist you establish high gainers

and losers, stocks on turbo momentum, and stocks that square measure close to flee on top

of resistance or break down below support lines, as explained on top of.

Online Trading bots

You can additionally change your trades on-line by employing a forex larva. These bots square

measure merely laptop programs with directions to execute a trade on your behalf supported

a planned set of market indicators and parameters. machine-controlled forex systems are often

accustomed trade stocks, options, futures and exchange merchandise supported a predefined

set of rules, that confirm once to enter Associate in Nursing order, once to exit a footing

and the way a lot of cash to take a position in every trading online product.

Trading bots will increase the percentages of success for amateur traders by bridging the gap

between their ignorance and events within the market to create sound forex selections. These

machine-controlled systems may scale back your direct involvement within the markets so you’ve

got ‘someone’ observance over your portfolio in your absence. whereas you’re at work, traveling,

or sleeping, your larva are going to be searching for new opportunities to book gains within

the market.

Trading bots square measure particularly useful to beginner traders as a result of they need

logic on their side; they create selections supported facts, whereas emotions and sentiments

square measure doubtless to cloud the reasoning of inexperienced traders. additionally, it’s

necessary to grasp that forex trading larvas aren’t created exclusively to assist you book

profits – sometimes; a bot are often a vital market ally for reducing your losses.

Online Trading algorithms

Many new traders tend to confuse trading bots with rule forex trading online – nonetheless they’re

basically totally different. recursive trading online is just a tool designed to assist traders

execute orders mechanically supported pre-programmed trading online directions like worth,

volume, and timing. you’ll additionally use recursive commercialism to interrupt down giant

orders that your online trading platform can’t execute in an exceedingly single trade.

The primary operate of recursive trading online is to assist you manage prices and minimize risks.

exploitation recursive commercialism for big orders may facilitate institutional investors

or individual investors with deep pockets to avoid spooking the markets.

Social trading

A third possibility beginners ought to take into account if they require to cut back the online

trading learning curve, is social online trading. Social forex is just a sort of forex trading

within which traders have confidence user-generated monetary content, collated from a range

of networks, to create online trading selections. Social commercialism provides you the platform

to be a part of a community of flourishing traders so you’ll distill the knowledge of the

gang to create trading selections.

You can utilize social trading uk to have interaction within the trading of various varieties

of securities like stocks, forex, commodities, and cryptocurrencies. Social trading is additionally

closely related to copy online trading – with copy trading online you’ve got a chance to

repeat the trades of alternative traders to create your online trading selections.

3 common mistakes online traders beginners ought to avoid

- Not employing a forex set up

- Many new traders square measure needing to enter the market to start out putting trades and

begin creating cash. - However, coming into the market while not a well-thought-out commercialism set up typically

ends up in large losses. while not a online trading set up, you’ll principally be reacting

to events within the market rather than acting logically. - Underestimating the importance of a online trading journal

A trading journal could be a helpful online trades tool that may means your mastery of the markets.

Recording all of your trades, the investment thesis behind the trades and noting however

the trades prove will assist you improve your commercialism acumen. A Forex trading journal

additionally makes it simple for you to try to to the post-trading analysis to crunch information

and steel oneself against consequent trade.

Changing online trading strategy once each trade

Some traders expertise beginner’s luck after they begin trading; but, most new traders tend

to lose some cash owing to their propensity to creating online trading mistakes. However,

ever-changing your trading online strategy once each loss can solely set you back on

the educational curve as a result of you’ll ne’er very master any of the online trading

ways.

The online trading exists as spot markets and derivatives markets. It offers currency, options, futures, and forwards swaps. Participants in the online trading use trading for hedging against international currencies and interest rate risk towards speculating economic events taking place across the globe and diversifying their portfolios among other things.

What is the Trading market?

The trading market is the place where the trading of currencies occurs. Currencies are used as a means of buying and selling across the globe and this is why they are considered to be very important globally. They are also used for conducting business and for foreign trade. For example, importers in the united states will have to first exchange the US dollars to Euro before they can import any item from France since the French seller will only receive Euro as a means of exchange. If you are a tourist traveling from France to the UK, you will need to exchange the Euro for Great Britain Pounds before you can carry out any transaction during your time in the UK. This is because the Great Britain Pound is the local currency recognized in the UK.

One thing that makes the international market to stand out is the fact that there is no central marketplace for foreign exchange. Instead, foreign exchange or currency trading is carried out electronically over-the-counter; this means that every transaction involved in trading online takes place via computer network connecting traders across the globe and not just one centralized exchange. The Forex market is available for the 24 hours of the day and 5 days of the week; some insist that it is open for 5 and a half days of the week. online trading also occurs in the major financial centers across the globe, which includes the following:

- London

- Sydney

- New York

- Paris

- Tokyo

- Singapore

- Zurich

- Hong Kong

- Frankfurt

The trading online also occurs across almost all time zones. As a result of this, online trading starts in New York, which experiences the first daylight of the day when trading day ends in the United States, it is just starting in places like honk Kong and Tokyo. This is the reason why the Forex market is always active virtually any time of the day and this is why the price quote changes constantly.

A brief history of Online trading and Forex

The stock market had been around for hundreds of years, but the same cannot be said about the Forex market. Forex market is relatively new and it has even become more popular than the stock market. online trading has to do with people concerning one currency to another to make a profit. While the Forex market is relatively new, it dates as far back as when people started using currencies as a means of exchange or when the world started minting currencies. Be that as it may, the old idea of Forex is not as vibrant as the modern idea, which is an entirely new invention that allows people to trade Forex or exchange one currency to another without actually owning those currencies. More major currencies were permitted to float freely against one another following the Bretton Woods accord of 1971. There is a variation in the prices of individual currencies and this has brought about the need for Forex trading and services.

Most of the online trading activities of today are carried out by investment and commercial banks; they do this on behalf of their clients that are interested in investing in the Forex market. This does not prevent speculative opportunities for trading one currency against another for individual and professional investors. It is also possible to trade stock online. Many stock traders now prefer online stick trading UK to the conventional way of trading stocks.

Forwards & Futures Markets and Spot Market

online trading is being done by individuals, corporations, and institutions via three different ways, which are:

- Spot market

- Forwards market

- Futures market

The spot market is undoubtedly the largest of the three since it is the underlying real estate on which the futures and forwards markets have their foundations. The futures market was the past popular in the past because it was made available to any individual investor for a very long time. The introduction of electronic trading and many Forex brokers make give the spot marker a huge advantage over the others, making it the largest of the three. The spot market has experienced an incomparable surge in trading activities and it has now fully overtaken the futures market since many traders now prefer using it.

The spot market is the place where currencies are bought and sold in line with their prices and values. The price is determined by supply and demand for that particular currency and it also reflects so many things that affect each of the currencies, some of which are:

- Interest rates

- Economic performance

- Sentiment towards currency political situation on the local and international stages.

- Perception of the future performance of currencies against each other.

A finalized deal in the spot market is called a spot deal. It can be defined as a bilateral transaction in which one investor delivers a particular amount of a currency earlier agreed upon and receives a given amount of another type of currency agreed upon with the counterparty. The settlement will be done in cash immediately once a position is closed.

Spot market involves the trading of actual currencies, but this is not the case with the futures and forwards markets, which are involved with the contracts representing claims to a given type of currency, future settlement date, and a particular price per unit.

Contracts are purchased in the forwards market and sold Over The Counter (OTC) between two parties. The two parties are responsible for determining the terms of the agreement between themselves.

The futures market has to do with the buying and selling of futures contracts during online trading UK based on the settlement date and standard size on public commodities markets like the Chicago Mercantile Exchange. The National Futures Association is responsible for regulating the futures market in the United States. Futures contracts come with specific details, like:

- Minimum price increments that cannot be customized

- Settlement dates

- Delivery date

- Number of units being traded

The exchange plays the role of a counterpart to the trader by providing settlement and clearance. Bear in mind that the terms currency market, foreign exchange market, Forex, and iqoptions all mean the same thing.

Forex for hedging

Companies that have their business established in foreign countries stand the risk of fluctuation in the price of the currency when they buy or sell goods and services in another country. The Forex market makes it possible for them to hedge currency risk and this can be done by fixing a rate at which the transaction can be completed.

To make this possible, the trader can buy or sell the currencies in a swap or forward market and this can be done in advance. Take for example a company that plans to sell a blender made in the US in the European market when the exchange rate between the two countries is 1:1 (EUR/USD).

The cost price of the blender is $100 and the company decides to sell it for 150 Euros and the price is competitive with what obtains on other blenders that are sold in Europe. This means that the company will make a profit of 50 euros, which is the same as $50 since the value of EUR/USD is 1:1. If the USD starts to rise in value against the euro and the exchange rate for EUR/USD changes from 1 to 0.8, this means that it will cost $0.8 to buy 1 euro.

If the company still makes the blender for $100 and sells it for 150 euro, it means the profit on the blender will reduce from $50 to $(50 x 0.8), which equals $20. A stronger USD, therefore, leads to a smaller profit. The risk faced by the company making the blender can be reduced by shorting the euro and purchasing the USD when the two are in parity. As a result of this, the profit made by the company will cover up the reduction in the fall in value when the USD rises. The profit will rise even further if the value of the USD falls and this will help to cover for the losses in the trade.

You can do this type of hedging in the futures market. Futures contracts are standardized and cleared by a central authority. Be that as it may, there may be less liquidity in the currency futures market compared to the forwards market. The latter exists within the interbank system and it is decentralized.

trading online for speculation

Several factors affect the demand and supply of currencies, some of which are:

- Interest rate

- Trade flows

- Tourism

- Economic strength

- Geopolitical risk

These factors are responsible for the volatility existing in the Forex market and they make it possible for traders to make a profit from online trading UK since they cause a frequent increase or decrease in value of one currency against the other. The increase in the strength of one currency indicates a reduction in the strength of the other since currencies are traded in pairs.

Currency as an asset

Currencies as an asset class are categorized into two

- The trader can earn from the difference between the interest rates of two currencies

- The trader can also make a profit from the difference in the exchange rate.

Online trading investors can make money from interest rate differences by purchasing the currency that has a higher interest rate and shorting the one that has a lower interest rate. The interest rate difference between the Japanese Yen and the British pounds was high before the 2008 financial crises and Forex investors took advantage of this by shorting the Japanese yen and buying the British pounds. Another name for this strategy is “carry trade”.

Why is it possible to trade currencies?

Before the internet came to the rescue, it was very difficult for investors to trade currency. Most of the organizations involved in currency trading in those days were high-net-worth individuals, hedge funds, and multinational corporations. This is because you need a lot of capital to trade Forex successfully. The interest now makes it possible for people to trade Forex with little capital. It now makes it possible for individuals with limited capital to trade Forex successfully.

The traders can either do this via brokers or banks. To make trading a lot more profitable to the individuals, the brokers offer high leverage to every online trading investor. As a result of this, they can control a large position with a very small account balance. Leverage makes it possible for the trader to make a lot of profit, but it also exposes the trader to a lot of risks. So, it should be used carefully.

Online trading risks

online trading is both complex and risky and online trading investors need to bear this in mind at all times. The regulations in the interbank market are of different types and there is no standardization in the online trading in some other parts of the world. The interbank market consists of banks that trade with one another all over the world. The banks have the responsibility to determine and also accept credit risk and sovereign risk. These banks have equally established effective internal processes. The regulations are imposed by the industry and ensure the protection of the banks that participate in the interbank market.

The market is made up of the banks that participate and they provide bids and offers for a given currency. As a result of this, the pricing mechanism in the market is based on supply and demand. There is a very large flow of trade in the system and this makes it difficult for fraudulent traders to influence the price of any given currency. The system ensures transparency for investors that have access to inter bank dealings.

Most of the small retail Forex traders carry out their trading with small and semi-unregulated brokers or dealers. Such brokers can re-quote prices and can even trade against the customers. The brokers may be regulated by government agencies or concerned industries, depending on the country where the broker is operating. Such regulations are, however inconsistent.

Before registering with a broker for Forex or online stock trading UK, it is very important to first find out if the broker is regulated or not. As a UK trader, you should be concerned with a broker that is regulated by relevant authorities in the UK, like the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). The two of them replaced the Financial Services Authority (FSA) in 2013, April 1st to be specific. The FCA is a non-government agency and it is funded by the various companies that the outlet regulates. However, the FCA reports to the Board put in place by the Treasury. The FCA has the responsibility to protect consumers and ensure stability in the Forex market. They also ensure that competition among financial service providers in the UK remains healthy. The agency is involved with the regulation of asset managers and financial advisers.

On the other hand, the Prudential Regulation Authority is affiliated to the Bank of England and has the major role of promoting a healthy financial system in the UK via the supervision and regulation of insurers, major investment firms, credit unions, and banks.

Benefits and challenges of online trading

Pros:

The Forex market is still the leading financial market as regards global daily trading volume. To, therefore, offers the most liquidity. It is, therefore, very easy to enter and exit positions in any major currencies in a fraction of seconds.

Challenges:

Dealers, brokers, and banks in the Forex market give the trader opportunities to use high leverage. As a result, the trader can easily control a large position with a very small amount of money. Leverage of 1:100 is considered to be high and it is commonly seen among brokers. A trader needs to understand the risk involved in using leverage; it can have a positive or negative influence on trading since it can either give you profit or loss. Extreme use of leverage can either make you rich or make the trader go bankrupt.

Pro:

The Forex market is open 24 hours of the day and 5 and a half days of the week. Trading activities start in Australia each day and ends in New York. The major centers for the Forex market across the globe are:

- New York

- London

- Paris

- Frankfurt

- Tokyo

- Singapore

- Honk Kong

- Sydney

Challenges:

A Forex trader requires a good understanding of economic indicators and fundamentals. He needs to know what goes on around the globe as far as the economy is concerned and he should know how these individual economic fundamentals relate to one another. This way, he will be able to grasp the particular fundamentals that drive changes in the values of currencies.

How to start online trading

In the course of this write-up, we have opened your eyes to the basic things you need to know about online trading and how it all begins. We have also shown you some of the benefits of trading Forex, as well as, some challenges you need to be wary of so that you will not get it wrong when you trade Forex. In this section, however, we are going to enlighten you about important steps to take when you want to start trading Forex online.

You can start trading Forex in just three steps that will be highlighted below:

- Open a trading account

- Fund your account

- Start trading

Yes, it is as simple as that. We are going to elaborate on each of these steps below:

Open a trading account

You will need to first look for a Forex broker to register with. There are so many of them out there today and you must choose carefully so that you will not end up with the wrong one. Look for a broker that offers a very simple and straightforward registration process. Find out also if the platform is secure or not before you register there to trade Forex. You will need to fill a short application form provided by the broker.

After the registration, you will need to go through a verification process before you can have access to the full features on the trading platform. Some brokers allow you to proceed with trading even before verification, while some other brokers insist that you must complete the verification process before you can start trading Forex on their platforms. To verify your account, you need to submit certain documents to the broker and the documents must meet the requirements before you can start trading Forex on that platform. Some Forex brokers can also connect you with an account manager immediately after your trading account has been verified. When choosing a Forex broker in the UK, always go for one that is regulated by the FCA. Your funds are safe with a regulated broker.

Fund your account

After you have registered with a regulated broker in the UK and you have verified your account, the next thing to do is to fund your account so that you can start trading Forex. You can easily fund your account with any of the methods supported by the broker, provide that method is convenient for you. Before you register with any broker, you can take time to find out if the broker offers deposit methods you can use conveniently. Most deposits are processed instantly and the money will be available in your account so that you can start trading Forex instantly. This is not always the case as some brokers delay in processing deposits and some deposit methods are delayed for some time before the funds are available in your trading account.

The amount to deposit can also depend on the minimum deposit amount required by the broker. You need to find out about this before you even register an account with the broker. Some brokers allow their registered members to deposit a small amount, while some other brokers demand huge minimum deposits. If you are a newbie in online trading in the UK, it is better to start with the minimum required deposit and you can increase your deposit as you gain more knowledge of online trading and become a better and more experienced trader.

Start trading

The next thing to do after depositing money in your online trading account is to start trading. Before you kick start your trading, however, make sure that you already have a good online trading strategy, a strategy that you can follow without any hassle. You also need to have a good money management strategy so that you will not lose your fund due to repeated losses. You should kick start your UK trading experience from a demo account. Make sure that the broker you choose offers a demo account. The demo account will give you an idea of how online trading works and you will also be given virtual money with which you can practice and learn the rope.

You can use the demo account to test run your trading strategy to know how effective it is. It is not advisable to venture into live trading until you are certain that your trading strategy is effective and reliable for trading Forex profitably. As a beginner, it is also better to stick to a particular currency pair than to jump from one currency pair to another. Sticking to just a currency pair will give you a very good understanding of the pair and make it a lot easier to make money by trading that pair. You can later venture into other currency pairs as your experience in Forex trading grows. Make sure that the platform where you register for Forex trading UK allows unlimited access to its demo account. You are also better off with a Forex broker that allows you access to the demo account before you make a deposit.

Tips for a successful online trading experience

As a newbie in online trading, you may find it very difficult to start making a profit. However, you can overcome the initial challenges and become one of the most profitable Forex traders if you have access to the right guidance and mentorship. The information you have read so far can help you to make better trading decisions so that you can record more profits than losses. Studies show that only about 5% of Forex traders make a consistent profit. The tips we are about to provide in this section of the write-up can go a long way to make you one of the 5% successful Forex traders.

Helpful tips to note

- Develop a particular trading style and goals and make sure you stick to it. It is unwise to venture into any UK trading activity without first developing a good strategy. After you have ascertained that the strategy is ok, you should stick to it no matter what.

- The Forex market is highly dynamic. This is to say that a particular Forex strategy that works very well today may become unprofitable in a couple of months. You need to understand this dynamism and always put it into consideration when trading Forex. This will translate you to the level of profitable Forex traders.

- Not all brokers are reliable. You should not register with that broker until you are sure that the broker is regulated by the FCA in the UK. This is not to say that other regulatory agencies around the world are not reliable. However, you are better off with a Forex trading UK platform regulated by the FCA. You can also trust those brokers regulated by international bodies, but make sure that they are regulated by tier-1 regulators.

- It is one thing to have a good Forex trading strategy that will tell you when to buy or sell, it is another thing to have a good exit strategy. An online trading UK strategy that does not include when to buy or sell and when to exit is not a good trading strategy. One other important thing to bear in mind is the money management strategy. You must prepare all these before you start trading Forex.

- Losses are part of the game and every trader must always bear this in mind. There is no 100% Forex trading strategy. This means there is no way you will not record losses. However, you will be on the safer side if your strategy records more profits than losses.

- You should always keep your emotion at bay when trading Forex so that you will not end up making unforgivable trading mistakes.

You can trade online and make money from the comfort of your home these days. What is more, you do not need much of an experience to do this successfully. As a result of this, both beginners and experts can use this method to make a lot of money. While it is possible to make a lot of money via online trading of beginners, you need to understand that you will not make millions from it at the start, making millions form such trading will take some time to come and it will be after series of ups and downs.

The dream of making millions under a few days of trading will never become a reality. As a reasonable trader, you should know that profiting from trading is a gradual process and will take some time from materializing. So, every newbie needs to start having a different opinion about trading lest he ends up badly.

Online trading should not be seen as a magic(Online trading for Beginners)

Those who see the online kind of trading as magic or a get-rich-quick scheme will end up being disappointed. If you have that kind of mentality, you will only get your fingers burnt. Instead, you should see online trading as a business and not as anything else. So, it is in your best interest to start treating trading as a business so that you can make a regular income from it.

The trend is your friend

You should always follow the trend when you are trading online as it will help you to make the right trading decisions a all times. This is one rule that every trader needs to bear in mind. Following the trend will help to reduce the occurrence of losses. If the trend shows that the particular asset you are concerned with is rising in value, then you should only consider taking a buying position. If the trend shows otherwise, then you should only consider selling a particular asset. When you follow the trend, the number of times you record losses will reduce. When the market is ranging or spiky, on the other hand, it is advisable to hold back from trading until the market makes up its mind about the particular direction to follow. Trading in a ranging market may cause you to record more losses.

Choose traders wisely

Trading online can be profitable and it can also be risky. So, you need to choose tread carefully so that you will not end up with more losses than profits. First of all, you need to choose the broker very carefully. There are so many brokers out there today claiming to be the best, but, unfortunately, not all of them can be trusted to deliver on their promises. This is why you need to choose carefully so that you will not end up with an unreliable broker. You should read up reviews about the online broker to find out if the broker is reliable or not. You should also avoid registering with a broker that is not regulated. Only regulated brokers can be trusted to protect the interests and funds of their clients. Your fund may go missing if you register with an unregulated broker.

Keep on learning

Forex trading online is a very risky business and you need to also bear this at the back of your mind. One of the factors responsible for the risky situation is its dynamic nature. Forex trading is dynamic and this means that market is consistently changing. A Forex trading strategy that worked yesterday may fail to work today because of the dynamic nature of the market. This means that the Forex trader will need to consistently adjust and modify his trading strategy so that it can be useful in the current market situation. If you are to successfully adjust your trading strategy to meet up with the current condition of the market, then you need to keep on learning so that you will not get it wrong. Learning is a constant thing for everyone that wants to trade online. The day you stop learning is the day you start failing. If you do not want to fail, then you must not stop learning. There is always something new to learn in Forex trading and the earlier you get down to it the better for you.

You need more than just the basic knowledge of trading of you to be able to make anything out of online trading for beginners. You need to get additional knowledge and make learning a daily engagement. You can look for sources of information for online trading for beginners that can help you to better understand how to go about trading online.

Put your risks under control

You should not trade Forex with money you cannot afford to lose. It is not wise to borrow money or take a loan for trading online. This is because you can end up with a huge loss that will put you in big debt. So, only trade Forex with money that will not put you in an emotional problem when you lose. Also, you should never risk more than 1 or 2% of your money when trading Forex online. You should calculate your risk based on how much money you have in your trading account and the calculation should have been done long before you start trading and make sure that your plans are made well before trading begins. Always remember that you can win or lose during Forex trading online. So, you must be prepared for eventualities.

Be ready to spare time

Forex trading will take time before you can understand how it works. Determining when to place trades can also take some time. So, you must be ready to spare the time before you can successfully trade Forex. Online trading is not something you can venture into if you do not have adequate time for market analysis lest you end up making mistakes that can cost you. This is even more important if you are into day trading. It may cause you to give up most of your day on trading analysis. It is not safe to start trading online if you do not have adequate time to spare on market analysis. Trading opportunities can come up at any time of the day or night. So, the trader needs to always be on the lookout lest he misses out.

Be ready to start small in Online trading for Beginners

One of the points online trading for beginners instructions should emphasize is the need to start small. Do not forget that trading online should be treated as a business and you should be ready to start your business small and look towards growing with time. This is exactly the case when it comes to online trading. If you are a newbie with limited knowledge about trading, then starting small is always in your best interest. You can now add more funds and go in big after you have built a lot of knowledge about trading. Even at that, you must not risk more than what you can afford to lose since the best of Forex trading online strategies can turn out to be unprofitable at the end of the day. You should always bear in mind that there is no 100% profitable strategy in Forex trading.

Conclusion

Traders that have limited funds should consider venturing into swing trading or day trading. These types of trading can be easily done in the Forex market than anywhere else. Traders that have bigger funds and prefer long term trading can focus on carrying trade or fundamental-based trading new Forex traders can become better and more profitable if they focus on understanding technical analysis and the macroeconomic fundamentals that drive changes in currency values. Before you start trading online UK, find out how reliable or otherwise the broker is and also develop a good trading strategy that has a high win rate.

Online trading frequently asked question in UK

What is online trading or trading online?

Trading, you either buy and sell shares yourself or you can use an advisor and have your money managed for you. Most of our Forex brokers offer you a dictated account manager that will help with your journey of trading online.

Which brokers demo account?

The Brokers that we have listed on our website offer demo trading account and educational courses to Sharpen your trading skills.

What is best trading platform for beginners?

We recommended XM as the Best Forex broker for beginners, with them you receive credits on your demo account, you can trade as much as you like using their trading demo account, when your ready you create a Live account.

Which broker offers the most Educational Support or Webinars?

- XM

- Easy Markets

- Avatrade

- CM Trading

- HYCM

- 24Options

- IQ Options

Is Online trading legal in United Kingdom?

Yes, trading online is legal from listed regulated Forex brokers.

What is best Strategy when come to trading online?

- Day Trading

- Scalping

- Swing trading

- Position trading

When it come to trading these methods are used the most and they work for many traders in the UK.

how to trade online?

You can trading by choosing our listed regulated forex brokers in UK here are the Steps:

- Create an Account

- Deposit the minimum amount required by the Broker.

- Receive educational courses from the Broker.

- Trade and Make money for yourself