Description

Those who wish to trade a greater sort of markets can access as many as 200+ different trading instruments on any given day via this broker. Those focused on the Forex market can trade a good sort of currency pairs starting from the majors to exotics, while easy Markets’ formerly Forex centered product offering has now expanded to incorporate Forex forward contracts, commodity and index CFDs, and vanilla Forex options.

As far as minimum spreads are concerned, the width of the spread depends on the sort of trading account the trader is executing transactions in. For a typical account, spreads start from three pips, while premium account holders get more competitive spreads beginning at 2.5 pips. The VIP account holders have access to rock bottom dealing spreads, which start at 0.9 pips.

While easy Markets spreads, the corporate has decided to stay things simple and transparent, offering fixed spreads for that reason. Having fixed spreads allows the trader a better level of certainty on executions, especially during volatile trading conditions.

Further the corporate provides you with exceptional trading conditions like free guaranteed stop loss / take profit, no slippage on easy Markets platform guaranteeing that your trade will placed at the precise price you clicked on, negative balance protection and tight fixed spread. Fixed spread, rather than variable spreads ensures price transparency. the corporate has lowered its spreads and now offers a number of rock bottom fixed spread within the market and competitive to floating spread:

EUR/USD: From 0.9 pips | GBP/USD: From 1.3 pips | USD/JPY: From: 1 pip | GOLD: From $0.35 pips.

Deposits and Withdrawals

Traders can use credit cards and electronic payment services to fund an easyMarkets trading account. the corporate currently accepts deposits via: Visa, American Express, Maestro, Giropay, Ideal, SoFortüberweisung, JCB, China Union Pay, Skrill (formerly Moneybookers), Webmoney, Uemadai and Neteller, additionally to via wire transfers from local and international banks.

The time delay for receiving deposits and withdrawals varies from virtually instant for those using Visa, American Express, Yemadai, China Union Pay, Ideal and Maestro, to 2 hours for Giropay, Skrill, Neteller and SoFortüberweisung. Using Webmoney and native and international bank wire transfers can take from three to 5 working days.

EasyMarkets uses an equivalent methods to process withdrawals, and no commissions are charged for deposits to or withdrawals from an easyMarkets trading account. the corporate processes all withdrawal requests within two business days, but counting on the bank and therefore the location where the funds are being sent, the method could take from 3 to 10 business days. there’s no minimum withdrawal amount, and every one withdrawals are sent back using an equivalent payment method because the original deposit was made with.

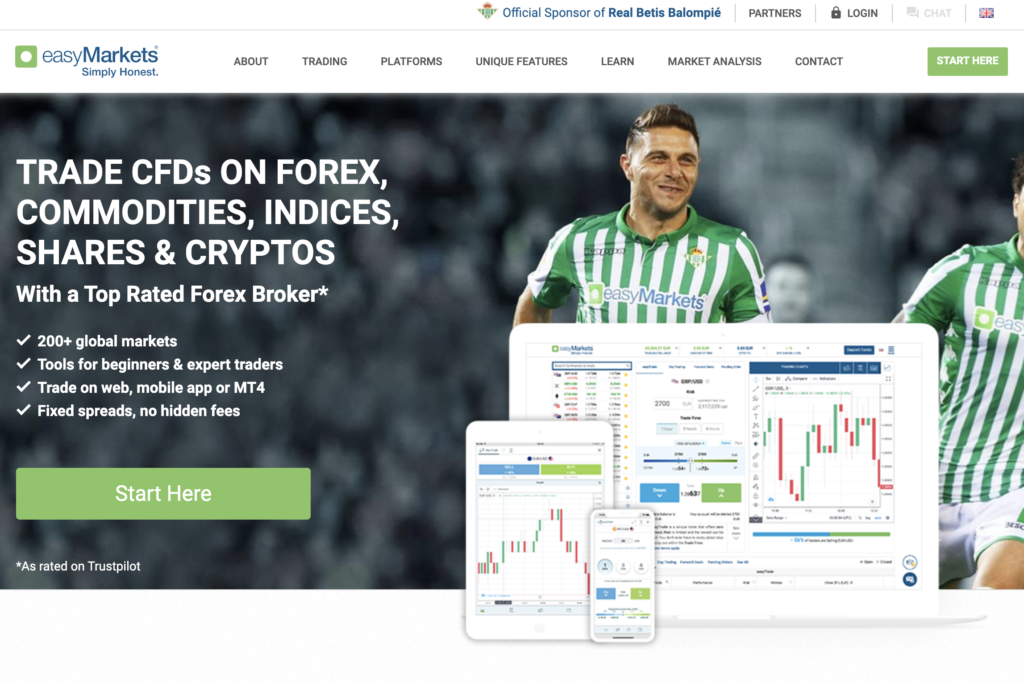

EasyMarkets offers an internet based trading platform that permits traders to execute deals from almost any online computer within the world with a browser. additionally , the corporate offers an MT4 trading platform that has its usual extensive support for technical traders.

This platform gives traders access to quote for quite 200+ instruments, including forex, commodities, metals and indexes, all with online access 24/7 and without the necessity to download and install any software. One click trading is out there from the platform’s Market Explorer, which incorporates advance charting options, news, technical analysis and market sentiment, all on one screen.

The screenshot below illustrates easyMarket’s trading platform that permits traders to execute deals in forex pairs, vanilla currency options, CFDs, commodities, precious metals and indices, also as perform technical and fundamental analysis functions.

EasyMarkets’ trading platform runs on Internet Explorer’s Version 10 and above, FireFox, version 31 and above, Google Chrome version 31 and better , Opera version 24 and above, Android version 4.1 and above, Google Chrome for Android version 37, and Safari version 7 and above. Non-supported browsers remain fully functional despite displaying some stylistic elements differently.

EasyMarkets users can unlock a 3rd trading platform: easyTrade. easyTrade are often accessed from the EasyMarkets platform. within the top right corner, there’s a Menu button. Hit that and variety of options will roll out, with easyTrade being at rock bottom .

In addition to dealCancellation, the broker also offers a singular trading tool called Freeze Rate. This feature lets traders freeze the worth they see, thus gaining a couple of seconds to put their trade. To those skilled enough, such a feature offers an excellent advantage.

Asset Classes

easy Markets enables traders’ access to over 200 markets like forex, indices, shares, agriculture commodities, energies, metals, cryptocurrencies and vanilla options and therefore the ability to trade them in many various ways like day trading, forwards, pending orders, options and in fact easyTrade.

Commission & Fees

In this regard, Easy markets’ offer may be a quite reasonable one. The broker doesn’t charge any commissions, or fees on account maintenance and deposits/withdrawals.

How does it make its money then? Through the spreads. The fixed spreads featured by EasyMarkets are 1 pip on the EUR/USD pair, for traders who use the online app, and 1.8 pips on an equivalent pair for those using MT4.

On other currency pairs (like the GBP/USD for instance) the spreads are even higher. Overall, the spreads charged by Easy Markets are at the upper end of the spectrum.

The marketing research section of the broker contains some educational material and variety of useful extras, like a Trading Charts section and a Financial Calendar.

Customer Service

Easy Markets’ customer service is out there with representatives on call 24/5 during normal forex market hours. Representatives will answer any Forex or account related questions and may provide guidance and instruction to clients. Customer service is out there via live chat, email, telephone or fax, with company staffed regional offices located round the world in Limassol, Cyprus, Sydney, Australia, Warsaw, Poland and Shanghai, China.

The company also offers educational material through their learning centers. Educational material includes videos, glossaries, eBooks and training articles for each level of trading expertise. An economic calendar, daily market commentary, technical charts and various trading tools round out the company’s educational and marketing research offerings.